EXPOSED: Coca-Cola bankrolls IRR research on sugary tax in SA

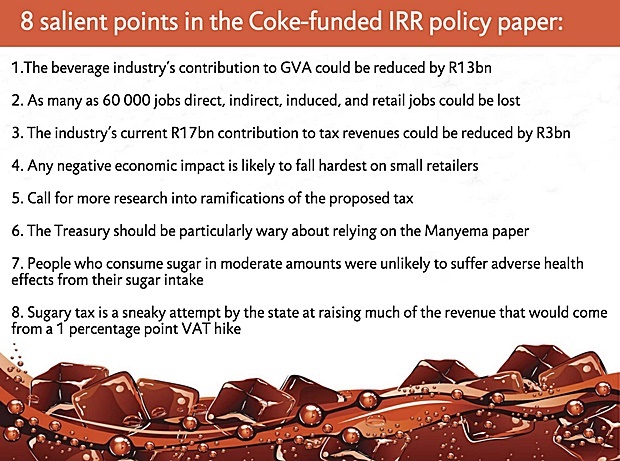

The IRR used the Coke-funded paper to engage with National Treasury about the economic impact a sugary tax will have in South Africa should it be introduced.

South Africa is the largest Coca-Cola market in Africa and consistently ranks among the best performing countries in the world, according to its website. It adds that consumers in more than 200 countries enjoy Coca-Cola's range of beverages at a staggering rate of 1.9 billion servings a day.

UPDATE: The IRR responded to the story on Wednesday, saying Fin24 should deal with the merits of the case it has made and not seek to discredit those findings by casting aspersions. (Click on the above link for the full response).

As a global leader in the beverage industry which derives its profits from selling soft drinks, the bottom line of Coca-Cola in South Africa would in all likelihood be squeezed by a sugary tax.

It is for this reason that the IRR turned to the beverage giant for funding to do research on the subject. Neither the IRR nor Coca-Cola publicly disclosed the funding source until Fin24 queried it.

"The IRR actively sought out this project by approaching groups that were likely to be negatively affected and asking for funding to do this research," media and public affairs officer Kelebogile Leepile told Fin24.

This was confirmed by Coca-Cola head of communications Zipporah Maubane.

"In response to a proposal by the IRR, the Coca-Cola system agreed to fund a research study examining the socio-economic impact of a tax on sugar-sweetened beverages."

Mystery over how much Coca-Cola poured into IRR research paper

However, the amount that Coca-Cola poured into the research is a mystery, with both parties refusing to loosen the cap on detailed questions posed by Fin24.

Although this is the first such incident in South Africa, Coca-Cola has been criticised over several similar incidents internationally.

It also comes hot on the heels of alleged leaked emails exposing the corporate giant's worldwide war against sugary taxes. These included trying to influence reporters, infiltrating the World Health Organisation (WHO) and lobbying governments.

"South Africans are fairly heavy consumers of sugar sweetened beverages," said Nigel Sunley, a technical consultant to the food industry.

"I do not have actual consumption figures at hand, but while our consumption is, for example, not as heavy as that in Mexico or the US, we are probably fairly high up the global table," he told Fin24.

In South Africa the beverage industry has desperately pushed against a tax on sugar-laden drinks - a proposal deriving from the Department of Health's strategy to reduce obesity - arguing the poor will bear the brunt.

In South Africa the beverage industry has desperately pushed against a tax on sugar-laden drinks - a proposal deriving from the Department of Health's strategy to reduce obesity - arguing the poor will bear the brunt.

However, when poor people become ill they turn to the already creaking public healthcare system that is under severe strain because of infectious diseases, such as HIV/AIDS and tuberculosis. This is further compounded by the burgeoning problem of non-communicable diseases (NCDs), including obesity and associated ailments like diabetes, heart disease and some cancers, which experts link to soft drink consumption. Sugar also has a negative impact on dental health and related costs.

The problem is so serious that the Second National Burden of Disease study released by the SA Medical Research Council (SAMRC) late in November urged for efforts to be scaled up in targeting prevention and management of NCDs. The study also showed concerning signs of an increase in diabetes mortality.

"In South Africa, NCDs account for a staggering 43% of recorded deaths," Professor Laetitia Rispel, head of the University of the Witwatersrand School of Public Health, told Fin24. "Poor people are disproportionately affected by these conditions."

She noted that the rates of overweight and obesity, a major risk factor for NCDs, have risen sharply and it is estimated that more than 45% of men and women above the age of 35 are either overweight or obese.

Reducing death & disease among the poorest

"The introduction of a tax in South Africa will decrease death and disease among the poorest, while providing much-needed finances to improve health," Rispel said.

Dr Anuschka Coovadia, an economist at KPMG and a medical doctor who worked in the public health sector, told Fin24 the management of NCDs is an important part of improving the well-being of South Africans.

“This management includes prevention of drivers of disease such as obesity, education, screening, early diagnosis and integrated management of care.”

She said South Africa needs to assess all levers which can be pulled to motivate, incentivise and penalise poor choices.

“As such, as sugar tax is one of the tools that we have in our toolkit. Other tools are important to assess in conjunction, as a single modality is unlikely to produce the outcomes we require.”

The WHO, which just last month urged for global action to curtail the consumption of sugary drinks, issued a report entitled Fiscal policies for Diet and Prevention of NCDs, stating that fiscal policies that lead to an increase of at least 20% in the retail price of sugary drinks would result in a proportional reduction in the consumption of these products.

In Sunley's view, the direct effect in South Africa of a tax on SSBs alone will be negligible.

"The actual reduction in sugar consumption will be extremely small, mainly because soft drinks constitute only a fairly small proportion of total sugar consumption."

Sunley said it is acknowledged that only a relatively small reduction in per capita consumption of soft drinks will result from the introduction of the sugary tax.

"The studies used by certain public health academics to motivate the proposed tax conveniently brush this over," Sunley claimed.